Imagine a bustling small business owner in Ohio, who, thanks to recent tax incentives, was able to upgrade their storefront, hire new staff, and expand their services—all during a turbulent economic period. Or picture a large corporation that decided to invest heavily in renewable energy projects, motivated by the tax policies introduced during the Trump administration. These stories illustrate how tax incentives serve as powerful tools to stimulate economic growth, create jobs, and shape industries.

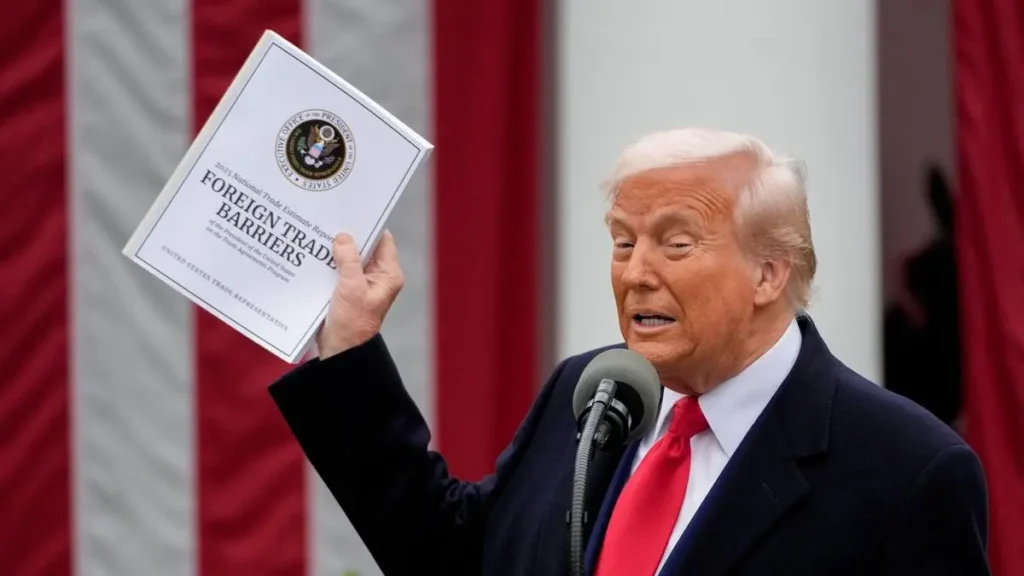

In this comprehensive exploration, we’ll unravel the intricacies of President Donald Trump’s approach to economic stimulus through tax incentives. We’ll examine the motivations behind these policies, their design, their real-world impacts, and lessons learned. Along the way, we’ll share insights from experts, real-world examples, and actionable advice for policymakers, business owners, and everyday citizens eager to understand how tax incentives can drive economic vitality.

The Foundations of Trump’s Economic Stimulus Strategy

When Donald Trump took office in January 2017, his administration faced a sluggish economic recovery post-2008 financial crisis, alongside concerns over stagnant wages and global trade uncertainties. To address these challenges, the administration prioritized tax reform as a core component of its economic policy.

The Philosophy Behind Tax Incentives

At its core, the Trump administration believed that reducing the tax burden on businesses and individuals would unleash a wave of investment, innovation, and job creation. The idea was rooted in supply-side economics—arguing that lowering taxes increases the incentives for productive activities, ultimately expanding the economy.

Economic theory supports this perspective; by decreasing marginal tax rates, the government aims to encourage work effort, capital formation, and entrepreneurship. But the real-world effectiveness of such policies depends heavily on their design and implementation.

The Key Legislation: The Tax Cuts and Jobs Act of 2017

The centerpiece of Trump’s tax policy was the Tax Cuts and Jobs Act (TCJA), enacted in December 2017. This sweeping legislation aimed to overhaul the U.S. tax code, with notable features including:

- Reduction of the corporate tax rate from 35% to 21%

- Introduction of immediate expensing for certain capital investments

- Deductions for pass-through entities

- Changes to individual income tax brackets

- Incentives for repatriating overseas profits

This law sought to make the U.S. more competitive globally and incentivize businesses to invest domestically. But beyond the headline numbers, there were numerous targeted tax incentives designed to stimulate specific sectors and activities.

Tax Incentives in Action: How Trump’s Policies Worked

1. Corporate Tax Cuts and Capital Investment

One of the most direct ways Trump’s policies aimed to stimulate the economy was by slashing the corporate tax rate. Lower taxes on corporate profits were expected to not only boost company earnings but also encourage reinvestment.

Real-world impact: Many corporations responded by increasing capital expenditures. For instance, during 2018 and 2019, reports indicated that companies like Apple and JPMorgan Chase announced significant investments in infrastructure and technology. According to the U.S. Chamber of Commerce, these investments were partly motivated by the favorable tax environment.

Expert insight: Economists like Dr. Martin Feldstein have argued that such tax cuts can have a short-term stimulative effect but may also lead to increased deficits if not offset by economic growth. The Congressional Budget Office (CBO) estimated that the TCJA would add hundreds of billions to the national debt over a decade, raising questions about long-term sustainability.

2. Bonus Depreciation and Immediate Expensing

A notable feature was the expansion of bonus depreciation, allowing businesses to immediately deduct a significant portion of their investments in equipment and machinery. This policy was designed to incentivize rapid capital deployment.

Impact on small businesses: For small and medium-sized enterprises, this tax incentive was particularly valuable. It lowered the upfront cost of investing in new assets, effectively reducing the hurdle for expansion.

Example: A manufacturing firm planning to upgrade its production line could deduct the full cost in the year of purchase, freeing up cash flow and encouraging quicker upgrades.

3. Incentives for R&D and Innovation

The TCJA also maintained and expanded certain tax credits for research and development (R&D), aiming to foster innovation. These incentives targeted high-tech sectors, biotech, and other R&D-intensive industries.

Industry impact: According to the National Science Foundation, R&D investments surged in the years following the tax reforms, with companies emphasizing innovation-driven growth.

4. Tax Incentives for Specific Sectors

The Trump administration targeted certain industries with tailored incentives:

- Energy and fossil fuels: Tax credits for oil and gas exploration, as well as deductions for renewable energy projects.

- Manufacturing: Special deductions and credits aimed at revitalizing American manufacturing.

- Real estate: Expanded depreciation rules benefited real estate developers and investors.

These sector-specific incentives reflected the administration’s broader economic priorities and aimed to stimulate growth in targeted areas.

The Broader Impact: Growth, Jobs, and Controversies

While the tax incentives unleashed some positive effects, the overall impact remains a topic of debate among economists, policymakers, and industry leaders.

Economic Growth and Job Creation

Short-term boost: The U.S. economy experienced a robust growth phase in 2018, with GDP expanding by approximately 2.9%, the highest since 2015. Unemployment rates fell to historic lows, and consumer confidence surged, according to the Bureau of Economic Analysis.

Long-term concerns: Critics argue that much of this growth was driven by borrowing and increased deficits, raising questions about sustainability. The Congressional Budget Office warned that the tax cuts would significantly increase the federal deficit, potentially leading to austerity or higher taxes in the future.

Wage and Income Effects

Some studies suggest that tax cuts disproportionately benefited higher-income households and corporations, with limited trickle-down effects to middle- and lower-income workers. The Economic Policy Institute pointed out that wage growth slowed in certain sectors despite the tax cuts, raising doubts about the direct benefits to everyday Americans.

Industry-Specific Outcomes

- Manufacturing and energy sectors: Experienced some revival due to targeted incentives.

- Small businesses: Benefited from pass-through deductions, but some faced increased compliance costs.

- Renewable energy: Saw mixed results; some projects advanced, but overall incentives were less significant compared to fossil fuels.

Comparing Tax Incentives: A Side-by-Side Look

| Aspect | Trump’s Tax Incentives | Traditional Stimulus Methods | Key Outcomes |

|---|---|---|---|

| Type | Tax cuts, immediate expensing, sector-specific credits | Direct government spending, grants, infrastructure projects | Encourages private investment, incentivizes specific activities |

| Speed of Impact | Rapid, as businesses can immediately utilize deductions | Slower, due to project planning and implementation | Quick boost to investment and confidence |

| Targeted Sectors | Manufacturing, energy, R&D, real estate | Often broad, such as infrastructure or social programs | Specific industry revival vs. general economic support |

| Fiscal Impact | Increased deficits, potential future tax hikes | Usually financed through government budgets | Short-term growth vs. long-term fiscal sustainability |

| Equity Considerations | Benefits skewed toward corporations and high-income earners | Can be designed to target lower-income groups | Distribution of benefits varies |

Note: For a detailed understanding of how different stimulus tools compare, the Brookings Institution offers comprehensive analyses.

Lessons Learned and Future Implications

The Trump-era tax incentives provide valuable lessons:

- Incentives can catalyze investment but must be carefully designed to ensure they target productive activities rather than simply shifting profits or encouraging stock buybacks.

- Fiscal sustainability matters. While immediate growth can be attractive, long-term deficits pose risks to economic stability.

- Sector-specific incentives can revive certain industries but may lead to distortions if not balanced with broader economic objectives.

- Distributional impacts are significant—tax cuts often benefit higher-income groups more, raising questions about fairness and social equity.

Looking ahead, policymakers can draw from these insights to craft balanced strategies that promote growth while maintaining fiscal discipline. For instance, targeted tax incentives can complement investments in infrastructure, education, and innovation—factors that underpin sustainable economic development.

Actionable Advice for Stakeholders

For Policymakers

- Design incentives with clear objectives: Ensure they incentivize genuine productivity rather than merely shifting profits.

- Monitor and evaluate impacts: Use data and studies to assess effectiveness and adjust policies accordingly.

- Balance incentives with fiscal responsibility: Incorporate sunset clauses or performance benchmarks to prevent long-term deficits.

For Business Owners

- Leverage available incentives: Stay informed about tax credits, deductions, and expensing options to optimize cash flow.

- Invest strategically: Focus on investments that will yield long-term growth, such as R&D and infrastructure upgrades.

- Consult experts: Work with tax professionals to navigate complex regulations and maximize benefits.

For Citizens and Consumers

- Understand how policies affect the economy: Recognize that tax incentives can influence job availability, prices, and services.

- Advocate for fairness: Support policies that promote equitable growth and fiscal responsibility.

- Stay informed: Follow credible sources like the Congressional Research Service for updates on policy impacts.

Frequently Asked Questions (FAQs)

Q1: Did Trump’s tax incentives lead to sustained economic growth?

A1: They contributed to a short-term boost, notably in 2018, but debates continue about whether the growth was sustainable or primarily driven by increased borrowing and deficits.

Q2: Who primarily benefited from these tax incentives?

A2: Higher-income households and large corporations gained more, especially through reduced corporate taxes and deductions, though some small businesses also benefited.

Q3: Were there any negative consequences?

A3: Yes. The increased deficits raised concerns about fiscal health, and some argue that income inequality widened because benefits were unevenly distributed.

Q4: Can tax incentives be a substitute for direct government spending?

A4: They can complement each other, but relying solely on incentives may not address broader infrastructure or social needs, which often require direct government action.

Q5: How do these policies compare globally?

A5: Many countries use tax incentives to stimulate growth, but the effectiveness varies based on design, economic conditions, and governance.

Q6: What metrics should I watch to evaluate the effectiveness of tax incentives?

A6: Key indicators include GDP growth, employment rates, income distribution, business investment levels, and fiscal deficits.

Conclusion: Weighing the Pros and Cons of Tax Incentives

President Trump’s use of tax incentives as an economic stimulus was a bold and multifaceted approach. It demonstrated that targeted tax policies can indeed spark investment, boost certain industries, and generate short-term economic momentum. However, it also highlighted the importance of careful design, transparency, and fiscal responsibility.

As the economy evolves, policymakers can draw lessons from this experience: incentives work best when aligned with long-term productive activities and balanced with sustainable fiscal strategies. For business owners and citizens alike, understanding the nuances of tax incentives empowers better decision-making and advocacy.

In the end, tax incentives are a powerful tool—when wielded wisely, they can promote innovation, growth, and fairness. The key lies in continuous evaluation, transparency, and a shared commitment to building an economy that benefits all Americans.

Next Steps: Stay informed about current tax policies by following updates from the Internal Revenue Service and reputable economic research institutions. Consider how strategic investments and advocacy can shape policies that promote equitable growth and fiscal sustainability. After all, informed citizens are the best advocates for a thriving economy.