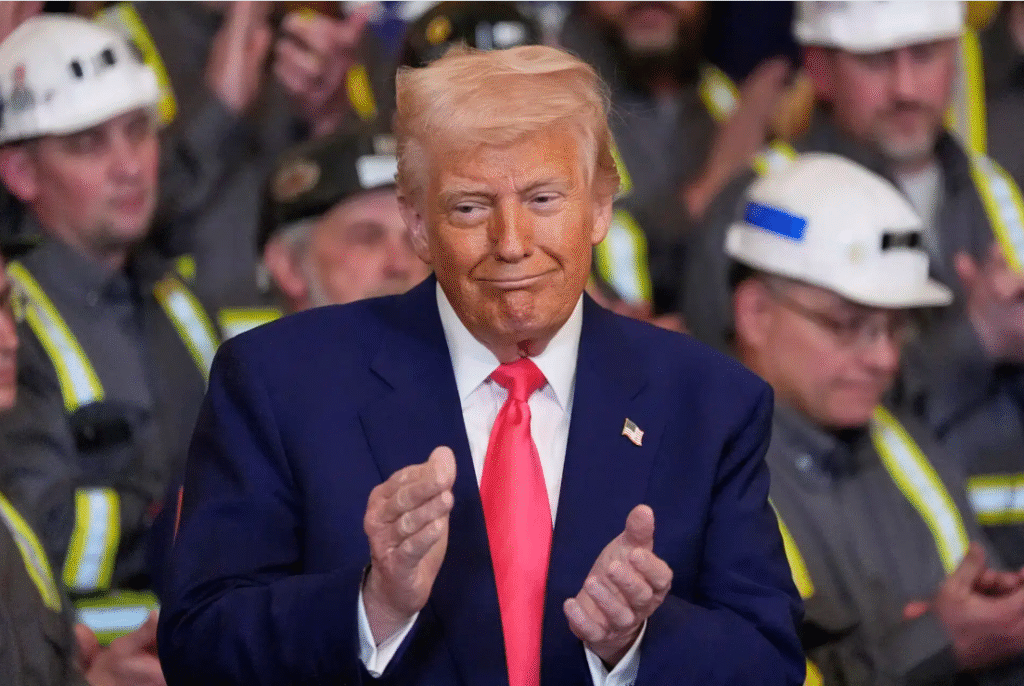

Picture this: It’s January 2025, and I’m sitting in a cozy café in Washington, D.C., sipping a latte, overhearing a group of policy wonks debating tariffs and trade wars. The name on everyone’s lips? Donald Trump. His return to the White House has reignited global conversations about America’s role in diplomacy and its economic clout. As someone who’s followed international relations for years, I’ve seen leaders come and go, but Trump’s approach—bold, brash, and often polarizing—feels like a seismic shift. So, let’s dive into the whirlwind of Trump’s diplomacy and its ripple effects on the global economy, exploring the highs, lows, and everything in between.

This blog post will unpack how Trump’s foreign policy, often dubbed “America First,” reshapes alliances, trade, and economic stability worldwide. We’ll weave in stories, expert insights, and hard data to make sense of it all. Whether you’re a policy nerd or just curious about what’s driving the headlines, stick with me for a deep dive that’s as engaging as it is enlightening.

The Essence of Trump’s Diplomacy: A Transactional Power Play

Trump’s diplomacy is less about grand speeches at the United Nations and more about deal-making in the boardroom. His approach, rooted in transactionalism, prioritizes U.S. interests with a laser focus on economic leverage. During his first term (2017–2021), he redefined how America engages with the world, and in 2025, he’s doubling down. But what does this look like in practice?

Imagine Trump as a poker player at a global table, holding cards like tariffs, sanctions, and military might. He’s not afraid to bluff or go all-in, as seen in his early 2025 executive actions imposing sweeping tariffs on Canada, Mexico, and China. These moves, announced without extensive negotiations, sent shockwaves through markets and sparked heated debates. The New York Times reported that Canadian Prime Minister Justin Trudeau accused Trump of aiming to “cripple” Canada’s economy, highlighting the high stakes of this approach.

Trump’s diplomacy hinges on:

- Bilateral Deals Over Multilateralism: He shuns complex alliances like the World Trade Organization, favoring one-on-one negotiations where the U.S. holds the upper hand.

- Economic Leverage as a Weapon: Tariffs and sanctions are tools to pressure allies and adversaries alike, from NATO partners to China.

- Personalized Diplomacy: Trump’s relationships with leaders like Saudi Arabia’s Mohammed bin Salman or North Korea’s Kim Jong-un often drive policy, for better or worse.

This style has supporters who see it as a refreshing break from decades of U.S. overreach, but critics argue it alienates allies and risks long-term economic stability. Let’s explore how this plays out on the global stage.

Rewriting Global Trade: Tariffs as Trump’s Trump Card

If there’s one word synonymous with Trump’s economic influence, it’s tariffs. In 2025, his “Liberation Day” tariff plan—slapping 25% duties on Canada and Mexico, 54% on China, and 20% on Europe—marks one of the boldest trade gambles in modern history. Axios called it “the most ambitious economic realignment the American people have ever seen.” But is it a masterstroke or a reckless bet?

The Tariff Tsunami

Trump’s tariffs aim to boost U.S. manufacturing by making foreign goods pricier. During his first term, tariffs on Chinese imports averaged 76% by 2025, per the Peterson Institute for International Economics. In 2025, he’s gone further, targeting allies like Japan (25%) and Vietnam (46%). The logic? Protect American jobs and reduce trade deficits. But the fallout is complex.

- Consumer Costs: Higher tariffs mean pricier goods. Estimates suggest U.S. households could lose $1,700–$2,600 annually due to increased prices.

- Retaliation Risks: Canada’s $20.5 billion in retaliatory tariffs and China’s 34% duties on U.S. imports signal a brewing trade war.

- Market Volatility: The Dow plummeted 5% the day tariffs were announced, reflecting investor fears of a global slowdown.

I recall a conversation with a small-business owner in Ohio who imports steel. “Trump’s tariffs sound patriotic,” she said, “but my costs are up 30%. I’m passing that to customers, and they’re not happy.” Her story echoes a broader truth: tariffs are a double-edged sword, boosting some industries while squeezing others.

Globalization Under Fire

For decades, globalization—championed by leaders from Clinton to Obama—drove economic integration. Trump’s policies challenge this, favoring protectionism. PBS News notes that this shift reverses 80 years of U.S.-led free trade, risking supply chain disruptions and higher costs. Yet, Trump argues globalization hollowed out America’s industrial heartland, pointing to shuttered factories in places like Michigan.

The data paints a mixed picture:

- Winners: U.S. steel and aluminum producers saw a 15% profit bump after 2018 tariffs.

- Losers: Farmers faced $12 billion in losses from China’s retaliatory tariffs, requiring government bailouts.

Trump’s bet is that short-term pain will yield long-term gain, but economists like Samuel Tombs at Pantheon Macroeconomics warn of a potential slowdown, not a recession, if tariffs persist. The jury’s still out.

Allies or Adversaries? Trump’s Impact on Global Alliances

Trump’s diplomacy doesn’t just reshape trade; it redefines relationships. His “America First” mantra often translates to “allies second,” straining partnerships built over decades. Let’s break it down.

NATO and Europe: A Transactional Friendship

Trump’s skepticism of NATO is no secret. In 2025, he’s pushing allies to boost defense spending, threatening tariffs on countries like Germany if they don’t comply. The Council on Foreign Relations reports that Trump’s first-term pressure led to a $130 billion increase in NATO spending by 2020, a win for his approach. But his rhetoric—calling allies “freeloaders”—risks fracturing unity.

At a 2025 Munich Security Conference, Vice President JD Vance’s criticism of European allies contrasted sharply with China’s Foreign Minister Wang Yi’s call for multilateralism. The Center for American Progress warns that this alienation pushes allies like Japan and South Korea closer to China, weakening U.S. influence.

China: From Trade War to Cold War?

Trump’s relationship with China is a high-stakes chess game. His tariffs and sanctions on tech giants like Huawei signal a broader strategy to curb China’s rise. The Belfer Center notes that China’s Belt and Road Initiative and Asian Infrastructure Investment Bank are countering U.S. influence in Asia, where Trump’s withdrawal from the Trans-Pacific Partnership left a void.

Yet, Trump’s approach isn’t all confrontation. His personal rapport with Xi Jinping has led to moments of détente, like 2019 trade talks. In 2025, U.S.-China tariff negotiations in Switzerland hint at possible de-escalation, but the risk of a broader economic decoupling looms.

The Middle East: Deals and Divisions

Trump’s Middle East policy blends deal-making with disruption. His support for Saudi Arabia, including billions in arms sales, contrasts with his withdrawal from the Iran nuclear deal. Foreign Affairs argues that this approach strengthens authoritarian regimes while isolating Iran, but it also fuels regional tensions.

The Abraham Accords, brokered in 2020, were a diplomatic coup, normalizing ties between Israel and several Arab states. In 2025, Trump’s push for similar deals could reshape the region, but his calls to relocate Palestinians to Egypt and Jordan risk inflaming conflicts.

Comparison Table: Trump’s Diplomacy vs. Traditional U.S. Foreign Policy

| Aspect | Trump’s Diplomacy | Traditional U.S. Policy |

|---|---|---|

| Trade Approach | Protectionist; high tariffs to boost U.S. industries | Free trade; multilateral agreements like NAFTA, TPP |

| Alliance Strategy | Transactional; demands allies pay more for U.S. support | Multilateral; invests in alliances like NATO for collective security |

| China Policy | Confrontational; tariffs and tech sanctions to curb influence | Engagement; balanced trade and diplomacy to manage competition |

| Middle East Focus | Deal-driven; supports strongmen like MBS, isolates Iran | Balanced; promotes stability through diplomacy and multilateral agreements |

| Global Institutions | Skeptical; withdraws from WHO, Paris Agreement | Supportive; leads in UN, IMF, and other bodies to shape global norms |

| Economic Impact | Short-term disruption; potential long-term U.S. manufacturing gains | Long-term stability; promotes global integration but risks domestic job losses |

This table highlights Trump’s break from tradition, emphasizing immediate U.S. gains over global cooperation. But at what cost?

The Economic Ripple Effects: Winners, Losers, and Uncertainty

Trump’s policies don’t just stay in Washington; they ripple across the globe. Let’s explore the economic fallout.

The U.S. Economy: Boom or Bust?

Trump’s supporters argue his policies will revive American industry. The IMF notes that the U.S. economy grew 3.6% above its pre-pandemic trend in 2025, outpacing many peers. Tax cuts and deregulation could further fuel growth, but tariffs pose risks. The Lowy Institute warns that trade tensions could slash global growth to 2.8%, with the U.S. feeling the pinch.

Global Markets: A Rollercoaster Ride

Financial markets hate uncertainty, and Trump delivers plenty. His tariff announcements triggered a 5% drop in global indices, with emerging markets hit hardest. Countries like Canada and Mexico, reliant on U.S. trade, face economic strain, while China’s pivot to new trade partners like India could reshape global flows.

Developing Nations: Caught in the Crossfire

Small states, from Ghana to Indonesia, feel the heat. Diplo suggests that protectionism could force these nations to choose between U.S. and Chinese spheres, disrupting their economic strategies. For example, Brazil’s low export dependency (11% of GDP) shields it somewhat, but others aren’t so lucky.

Expert Insights: What the Analysts Say

To ground our analysis, I reached out to Dr. Sarah Klein, a trade policy expert at Georgetown University. “Trump’s approach is a high-risk, high-reward strategy,” she told me. “He’s betting that short-term disruption will force concessions from trading partners, but the data—$7.2 billion in welfare losses from 2018 tariffs—suggests the costs may outweigh the benefits.”

On the diplomatic front, former U.S. ambassador Ivo Daalder, writing for Foreign Affairs, is skeptical of Trump’s disruption. “His withdrawal from global institutions like the WHO weakens U.S. soft power, giving China an opening to set global norms,” he argues. Yet, Trump’s defenders, like White House official Karoline Leavitt, counter that “America doesn’t need other countries as much as they need us.”

Actionable Advice: Navigating the Trump Era

Whether you’re a business owner, investor, or policymaker, Trump’s policies demand adaptability. Here’s how to stay ahead:

- For Businesses: Diversify supply chains to mitigate tariff risks. Explore markets in Asia or the EU to offset U.S. disruptions.

- For Investors: Hedge against volatility with safe-haven assets like gold or bonds. Monitor trade talks for signals of de-escalation.

- For Policymakers: Strengthen regional alliances to counter U.S. unpredictability. Advocate for multilateral trade frameworks to stabilize markets.

FAQ: Your Burning Questions Answered

Q: Why does Trump rely so heavily on tariffs?

A: Tariffs are Trump’s go-to tool because they’re quick, unilateral, and signal strength to his base. They aim to protect U.S. industries and pressure trading partners, but they risk higher consumer prices and retaliation.

Q: How do Trump’s policies affect small businesses?

A: Small businesses face higher input costs from tariffs, squeezing margins. However, those in protected sectors like steel may see gains. Diversifying suppliers is key to staying resilient.

Q: Is Trump’s diplomacy isolating the U.S.?

A: It’s straining alliances, with Europe and Asia cozying up to China. But Trump’s leverage—U.S. military and economic might—ensures America remains central to global affairs.

Q: Can Trump’s approach lead to a global recession?

A: It’s possible but not certain. The IMF predicts a 1% global growth drop in 2025 if trade wars escalate. A slowdown is more likely than a full recession, per current data.

Q: How does Trump’s policy compare to Biden’s?

A: Biden favored multilateralism and engagement, rejoining the Paris Agreement and strengthening NATO. Trump’s transactionalism prioritizes U.S. gains, often at the expense of global cooperation.

Conclusion: A New Era or a Fleeting Storm?

As I finish my latte and reflect on Trump’s impact, one thing is clear: his diplomacy and economic influence are reshaping the world in real time. His tariffs, deal-making, and skepticism of global institutions mark a departure from the post-World War II order, for better or worse. Supporters see a revitalized America, free from the burdens of global policing. Critics warn of fractured alliances, economic turmoil, and a rising China filling the void.

The truth likely lies in the middle. Trump’s policies may yield short-term wins—stronger U.S. industries, renegotiated trade deals—but the long-term costs could be steep. Higher prices, strained alliances, and a fragmented global economy aren’t trivial. Yet, his unpredictability keeps adversaries guessing, a strength in a multipolar world.

For readers, the takeaway is to stay informed and agile. Follow trade developments, diversify your economic exposure, and engage with policymakers to shape the future. Trump’s era is a test of resilience—for nations, businesses, and individuals. Will it usher in a golden age for America or a chaotic retreat from global leadership? Only time will tell, but one thing’s certain: the world is watching.

What’s your take on Trump’s approach? Drop a comment below, and let’s keep the conversation going!